News Details

Intchains Group Limited Reports Third Quarter 2023 Unaudited Financial Results

SHANGHAI, China, Nov. 16, 2023 (GLOBE NEWSWIRE) — Intchains Group Limited (Nasdaq: ICG) (“we,” or the “Company”), a provider of integrated solutions consisting of high-performance computing ASIC chips and ancillary software and hardware for blockchain applications, today announced its unaudited financial results for the third quarter ended September 30, 2023.

Third Quarter 2023 Operating and Financial Highlights

- Sales volume of ASIC chips was 165,056 units for the third quarter of 2023, representing a decrease of 70.3% from 555,350 units for the same period of 2022.

- Revenue was RMB6.8 million (US$0.9 million) for the third quarter of 2023, representing a decrease of 94.6% from RMB126.4 million for the same period of 2022.

- Net loss was RMB19.1 million (US$2.6 million) for the third quarter of 2023, compared to a net income of RMB96.6 million for the same period of 2022.

Mr. Qiang Ding, Chairman and Chief Executive Officer of Intchains, commented, “Despite the challenging condition in the blockchain market in the third quarter, we remain confident in the growth of the WEB3 industry and the abundant applications that blockchain technology can bring across a range of industries. Throughout the quarter, we continued to make technological breakthroughs as an industry pioneer. In October, we completed the tape-out of our new generation of chips on new process node, which incorporates innovative blockchain algorithms. We plan to commence mass production of the chips in the first quarter of 2024”.

Mr. Ding continued, “Starting in the fourth quarter, we began to observe an accelerated recovery in the market. To better capitalize on the new growth potential, we will continue to advance our leading technical advantages and explore further industry potentials, particularly in collaboration opportunities with the downstream industry value chain. We recently entered into a non-binding letter of intent with a Singapore-based blockchain company for the acquisition of a portfolio of intellectual property rights, information and technical materials associated with its “Goldshell” brand, which is a WEB3 infrastructure brand. This acquisition, if completed, would allow us to enter the downstream production and sales sector across mining equipment and other WEB3 infrastructure related hardware and software products with a multi-branding strategy. Once completed, this transaction will broaden our offerings for existing customers with new products and brand choices, while enabling us to reach a large market more effectively. With the market recovery picking up stream in the fourth quarter, we are very excited to better serve our customers with an array of diversified products and services, which will empower them to achieve their goals and ultimately promoting the overall industry development.”

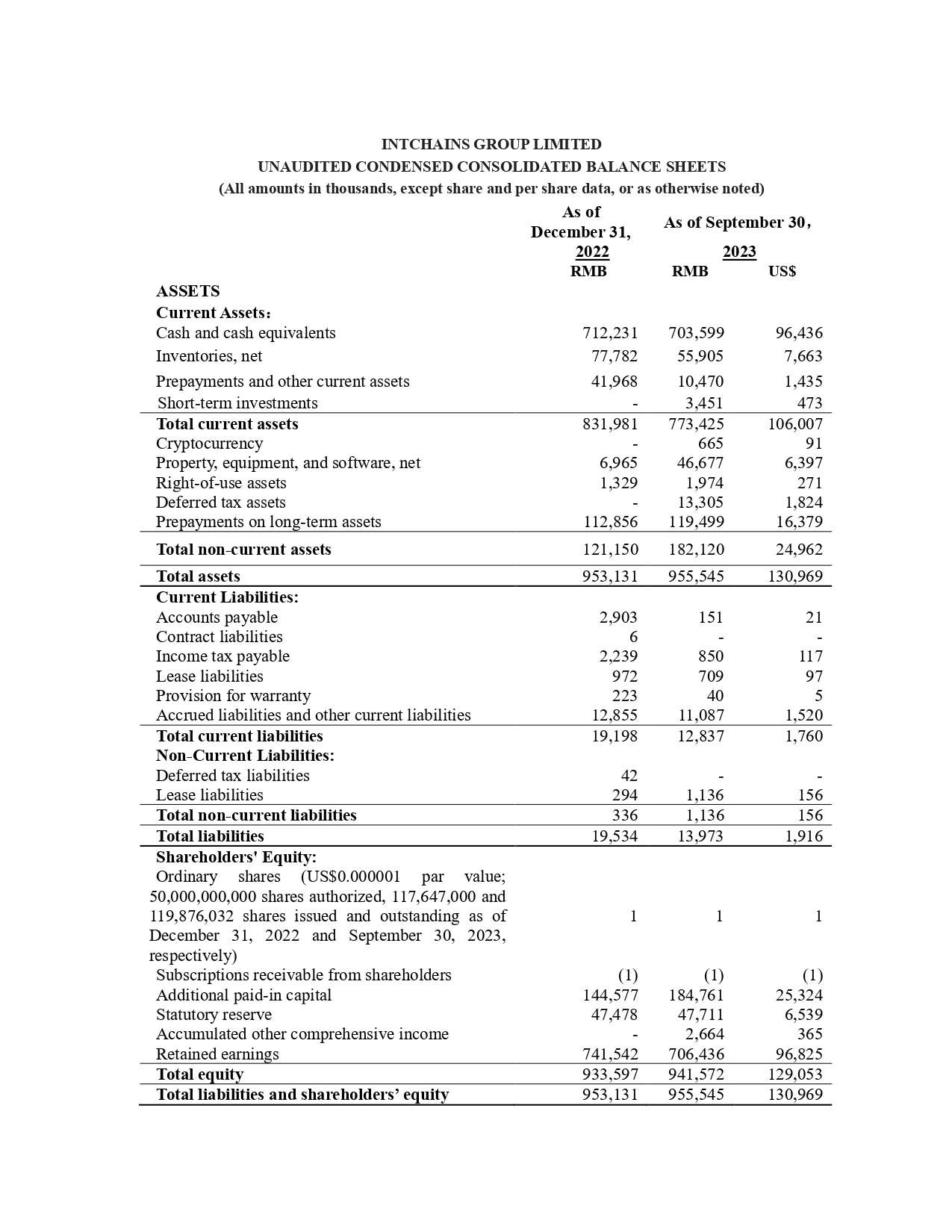

Third Quarter 2023 Financial Results

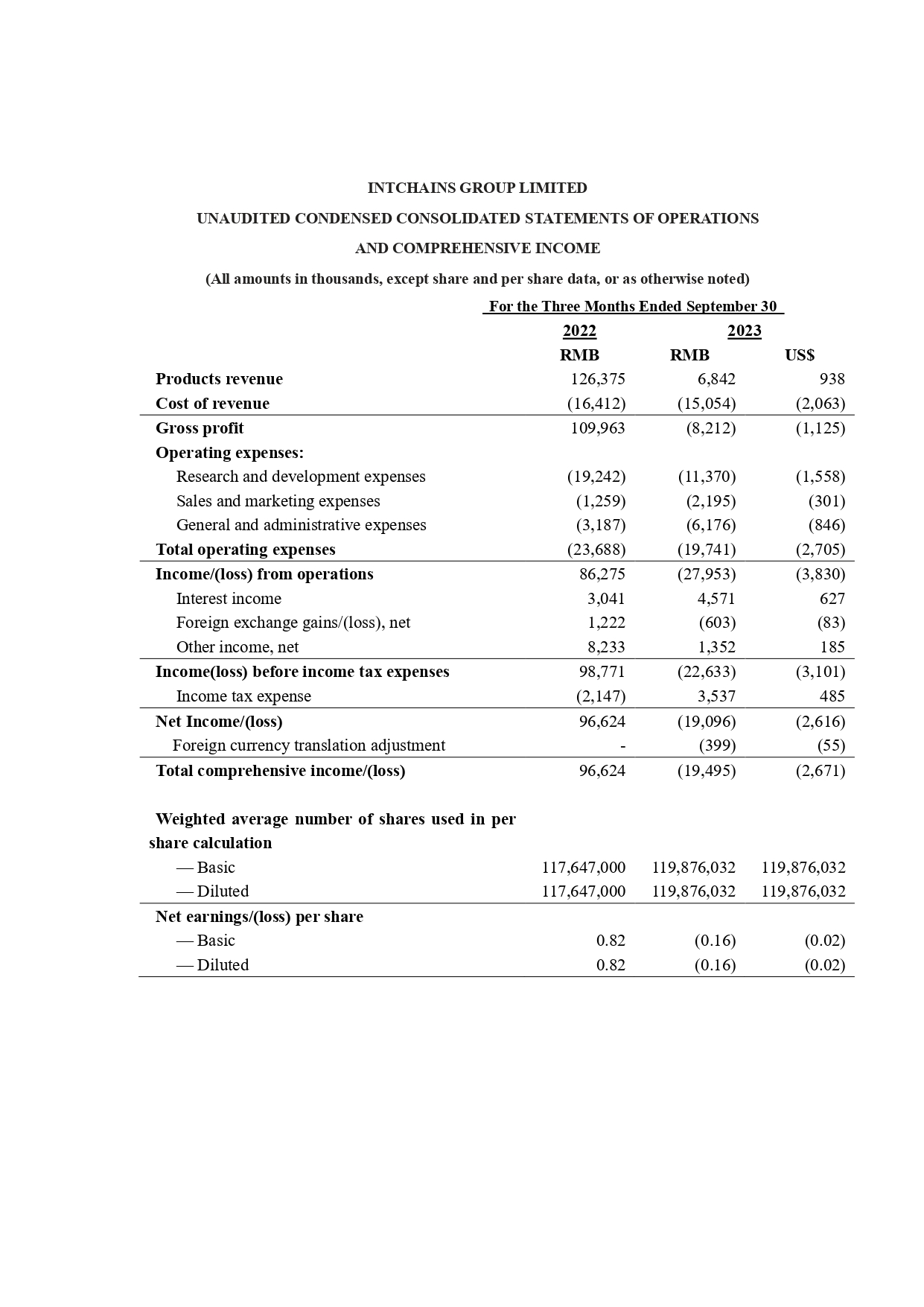

Revenue

Revenue was RMB6.8 million (US$0.9 million) for the third quarter of 2023, representing a decrease of 94.6% from RMB126.4 million for the same period of 2022. The decrease was mainly due to the challenging cryptocurrency market in the third quarter, which resulted in decreases in the sales volume and average selling price of our ASIC chips that were primarily used in cryptocurrency mining machines.

Cost of Revenue

Cost of revenue was RMB15.1 million (US$2.1 million) for the third quarter of 2023, representing a decrease of 8.3% from RMB16.4 million for the same period of 2022. The decrease was mainly attributable to the decrease in sales volume of our ASIC chips, largely offset by an inventory write-down and a prepayment write-down, totaling approximately RMB10.3 million. The write downs were primarily due to unfavorable market conditions and decreased sales.

Operating Expenses

Total operating expenses were RMB19.7 million (US$2.7 million) for the third quarter of 2023, representing a decrease of 16.7% from RMB23.7 million for the same period of 2022. This decrease was primarily due to a decrease in research and development expenses, partially offset by the increases in sales and marketing expenses and general and administrative expenses.

- Research and development expenses decreased by 40.9% to RMB11.4 million (US$1.6 million) for the third quarter of 2023 from RMB19.2 million for the same period of 2022. The decrease was primarily attributable to the different stages our research and development projects were in during the respective period.

- Sales and marketing expenses increased by 74.3% to RMB2.2 million (US$0.3 million) for the third quarter of 2023 from RMB1.3 million for the same period of 2022, mainly due to an increase in personnel-related expenses.

- General and administrative expenses increased by 93.8% to RMB6.2 million (US$0.8 million) for the third quarter of 2023 from RMB3.2 million for the same period of 2022, primarily due to an increase in labor cost and professional expenses, partially offset by a decrease in tax surcharges.

Interest Income

Interest income increased by 50.3% to RMB4.6 million (US$0.6 million) for the third quarter of 2023 from RMB3.0 million for the same period of 2022, mainly attributable to the increase in our cash balance, which is a result of our effective fund management.

Other Income, Net

Our other income, net, decreased by 83.6% to RMB1.4 million (US$0.2 million) for the third quarter of 2023 from RMB8.2 million for the same period of 2022. The decrease was primarily due to a decrease in grants received from the local government. The grants were issued in support of eligible IC industry projects with no repayment obligations.

Net Loss

As a result of the foregoing, we recorded a net loss of RMB19.1 million (US$2.6 million) for the third quarter of 2023, compared to a net income of RMB96.6 million for the same period of 2022.

Basic and Diluted Net Loss Per Ordinary Share

Basic and diluted net loss per ordinary share were RMB0.16 (US$0.02) for the third quarter of 2023, compared with basic and diluted net earnings per ordinary share of RMB0.82 for the same period of 2022. Each ADS represents two of the Company’s Class A ordinary shares.

Recent Developments

In October, we completed the tape-out of our new generation of chips on new process node, which incorporates innovative blockchain algorithms. We plan to commence mass production of the chips in the first quarter of 2024, subject to the satisfactory result of the IC verification and trial production processes.

In November 2023, we entered into a non-binding letter of intent with a Singapore-based blockchain company for the acquisition of a portfolio of intellectual property rights, information and technical materials associated with its “Goldshell” brand. We believe that such acquisition, if completed, would allow us to enter the downstream production and sales sector across mining equipment and other WEB3 infrastructure related hardware and software products with a multi-branding strategy. The Company intends to issue a press release upon entering into the formal transaction documents for the aforementioned acquisition.

Conference Call Information

The Company’s management team will host an earnings conference call to discuss its financial results at 8:00 P.M. U.S. Eastern Time on November 16, 2023 (9:00 A.M. Beijing Time November 17, 2023). Details for the conference call are as follows:

Event Title:

Date:

Time:

Registration Link:

Intchains Group Limited Third Quarter 2023 Earnings Conference Call

November 16, 2023

8:00 P.M. U.S. Eastern Time

https://register.vevent.com/register/BI47d10b28eff4422f9eba6f213dd90891

All participants must use the link provided above to complete the online registration process in advance of the conference call. Upon registering. each participant will receive a set of dial-in numbers and a personal access PIN, which will be used to join the conference call.

Additionally, a live and archived webcast of the conference call will also be available at the Company’s website at: https://intchains.com/.

About Intchains Group Limited

Intchains Group Limited is a provider of integrated solutions consisting of high-performance ASIC chips and ancillary software and hardware for blockchain applications. The Company utilizes a fabless business model and specializes in the front-end and back-end of IC design, which are the major components of the IC product development chain. The Company has established strong supply chain management with a leading foundry, which helps to ensure its product quality and stable production output. The Company’s products consist of high-performance ASIC chips that have high computing power and superior power efficiency as well as ancillary software and hardware, which cater to the evolving needs of the blockchain industry. The Company has built a proprietary technology platform named “Xihe” platform, which allows the Company to develop a wide range of ASIC chips with high efficiency and scalability. For more information, please visit the Company’s website at: https://intchains.com/.

Exchange Rate Information

The unaudited United States dollar (“US$”) amounts disclosed in the accompanying financial statements are presented solely for the convenience of the readers. Translations of amounts from RMB into US$ for the convenience of the reader were calculated at the noon buying rate of US$1.00=RMB7.2960 on the last trading day of the third quarter (September 29, 2023). No representation is made that the RMB amounts could have been, or could be, converted into US$ at such rate.

Forward Looking Statements

Certain statements in this announcement are forward-looking statements. These forward-looking statements involve known and unknown risks and uncertainties and are based on the Company’s current expectations and projections about future events that the Company believes may affect its financial condition, results of operations, business strategy and financial needs. Forward-looking statements include, but are not limited to, statements about: (i) our goals and strategies; (ii) our future business development, formed condition and results of operations; (iii) expected changes in our revenue, costs or expenditures; (iv) growth of and competition trends in our industry; (v) our expectations regarding demand for, and market acceptance of, our products; (vi) general economic and business conditions in the markets in which we operate; (vii) relevant government policies and regulations relating to our business and industry; and (viii) assumptions underlying or related to any of the foregoing. Investors can identify these forward-looking statements by words or phrases such as “may,” “could,” “will,” “should,” “would,” “expect,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “project” or “continue” or the negative of these terms or other comparable terminology. The Company undertakes no obligation to update or revise publicly any forward-looking statements to reflect subsequent occurring events or circumstances, or changes in its expectations, except as may be required by law. Although the Company believes that the expectations expressed in these forward-looking statements are reasonable, it cannot assure you that such expectations will turn out to be correct, and the Company cautions investors that actual results may differ materially from the anticipated results and encourages investors to review other factors that may affect its future results in the Company’s registration statement and other filings with the SEC.

For investor and media inquiries, please contact:

Intchains Group Limited

Investor relations

Email: [email protected]

Piacente Financial Communications

In China

Helen Wu

Tel: +86-10-6508-0677

Email: [email protected]

In The United States

Brandi Piacente

Tel: +1-212-481-2050

Email: [email protected]